Analysis: 4.7 Million Uninsured People Nationally Could Get a No-Premium Bronze Plan in the ACA Marketplace

As the Affordable Care Act’s open enrollment period nears an end in most areas this week, a new KFF analysis finds that 4.7 million currently uninsured people could get a bronze-level plan for 2020 and pay nothing in premiums after factoring in tax credits, though the deductibles would be high.

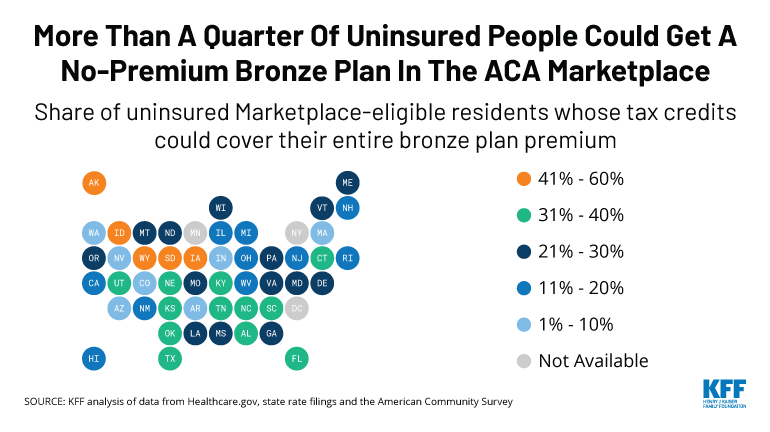

That works out to 28 percent of the 16.7 million uninsured individuals who are potential customers for coverage through ACA marketplaces.

Half of the uninsured who could get a free bronze plan live in one of four large states: Texas (1,151,300 people), Florida (694,800), North Carolina (338,200) and Georgia (303,600). The analysis has detailed data on the number and share of the uninsured in each state who have access to a free bronze plan.

Iowa by far has the largest share (59%) of potential marketplace customers who could enroll in a bronze plan without having to pay a premium. This reflects a combination of factors, including the state’s relatively high premiums for its benchmark silver plan that results in larger tax credits for low- and moderate-income residents.

Other states with large shares of uninsured residents who could sign up for a no-premium bronze plan include Alaska (45%), Wyoming (44%), Idaho (41%), South Dakota (41%), North Carolina (40%), Oklahoma (40%) and South Carolina (40%).

Consumers may want to consider paying a premium for a silver plan instead so that they can benefit from cost-sharing subsidies available under the ACA. The ACA’s cost-sharing subsidies are available to people with incomes below 250% of the federal poverty level who sign up for a silver plan, resulting in deductibles ranging from $209 to $3,268 depending on income level.

In most states, potential customers have until Sunday, Dec. 15 to sign up for a marketplace plan, though a few states that run their own marketplaces have extended open enrollment periods. KFF’s Health Insurance Marketplace Calculator allows users to enter their income, age, and family size and get estimates of premiums and available subsidies for insurance purchased on the ACA exchanges. In addition, KFF has updated its searchable online collection of 300 frequently asked questions about the health insurance marketplace, tax credits and other open-enrollment consumer issues.

This analysis appeared in Kaiser Family Foundation’s e-newsletter. Read more here.